China recently announced restrictions on rare earth and magnet exports that could have sweeping consequences on global critical raw materials supply chain, especially for the European Union.

As per the new rules released by the Chinese Ministry of Commerce, foreign companies will now require Beijing’s approval to export/supply rare earth metals produced in China or processed with technologies outside China. Essentially, the new rule also applies to rare earth magnets produced abroad as well as semi-conductor materials which contain even trace amounts of rare earth metals sourced from China.

Although Beijing’s new rule was announced ahead of US President Donald Trump’s visit to South Korea in October this year where the two leaders met for the first time since 2019, the decision has global supply chain implications, notably for Europe.

China dominates rare earth metals processing

China currently dominates the rare earth metals market, controlling the majority of the world’s processing capacity. With this new rule, Beijing seeks to further consolidate its control over rare earths that are essential to a spectrum of technologies like renewable energy (electric vehicles, wind turbines) and defence sector, all of which are also strategic sectors of importance to the EU.

Unsurprisingly, this latest export restriction could have an impact on the EU’s CRM supply chain due to the bloc’s reliance on other countries for rare earth metals, including China, especially in times of geopolitical uncertainty.

Potential implications on EU

Moreover, the EU’s demand for rare earth metals, especially lithium, is expected to increase twelve-fold by 2030 and twenty-one-fold by 2050 (EU CRMA Act).

In the face of these demand and supply risks in a geopolitically tense global political environment, securing access to a sustainable supply of CRMs and establishing sustainable value chains, including developing a robust single-market for secondary raw materials, are critical to the EU economy to reduce dependencies, enhance EU’s risk-monitoring capacities and improve circularity.

Similarly, as per the CRMA act, two of the four main benchmarks set to enhance domestic capacities by 2030 is to recycle at least 25% of the EU’s annual consumption of strategic raw materials, and no more than 65% of EU’s annual consumption should be from a single third country.

R&I projects are crucial to EU’s competitiveness and resilience strategy

To achieve these benchmarks, the EU is also pouring billions of Euros into Research and Innovation (R&I) projects to strengthen its strategic autonomy, resilience, and competitiveness, especially in the context of CRMs.

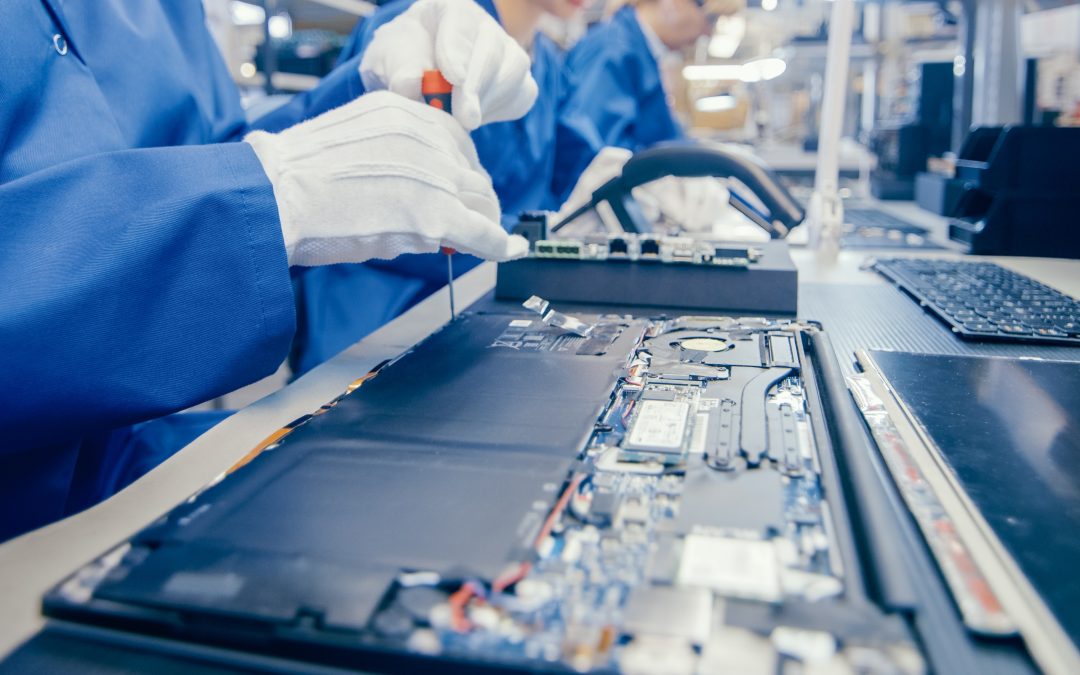

The iBot4CRMs, a Horizon Europe Research and Innovation project, is an initiative of strategic importance. We are helping to develop technologies to recover and recycle CRMs such as neodymium (for magnets), copper, gold, and silver to secure these materials to be self-reliant, competitive, and resilient.

The project is undertaking a raft of activities to improve CRM recovery rates, reduce environmental impact, and pave the way for a new approach to critical raw materials (CRM) recovery, while also acknowledging the challenges ahead. The innovation project will develop scalable technologies and test them across seven real world scenarios, focusing on end-of-life e-vehicles, electronic and electrical waste, metal scraps, incineration slag, and other urban waste streams.

Currently, Europe recycles less than 1% of its rare earth elements, despite these critical materials being essential to produce a wide array of electronic and automotive products, as well as for the advancement of sustainable technologies (Rare Earth Magnets and Motors: A European Call for Action).

By leveraging its consortium, iBot4CRMs intends to maintain strong ties with various EU initiatives and projects, fostering synergies and strengthening a cohesive strategy for circularity and raw material resilience.